tomport.site

News

How To Go About Buying A Foreclosure

If you want to buy a foreclosed home, you should be able to purchase one using a government-backed or conventional mortgage, but the property will need to pass. Many banks and mortgage companies will require you to be pre-approved for a loan before you ever make an offer on a foreclosed property. This ensures them that. There are a few different ways to purchase a foreclosed home including a short sale, at auction, buying from the bank or buying from the government. Buying a. Although buying a foreclosed home at auction may seem attractive, experts warn of the risks of doing so. This is because inspection limitations increase. A more direct route is to go through websites that specialize in homes and properties in foreclosure, such as Fannie Mae's HomePath. When purchasing a foreclosed home, the type of financing you need depends on the stage of foreclosure. Foreclosure auctions typically require buyers to pay in. They need repairs—sometimes major—and they're sold “as-is,” meaning that the lender is not going to make improvements to the property for you before you buy it. How to buy a home foreclosure: 5 key steps · Step 1: Find a rockstar local agent or broker · Step 2: Other ways to find foreclosed homes · Step 3: Get your. Yes, you can. In most cases, purchasing a foreclosed home is an investment rather than a first home, so chances are you already have a pre-existing mortgage. If you want to buy a foreclosed home, you should be able to purchase one using a government-backed or conventional mortgage, but the property will need to pass. Many banks and mortgage companies will require you to be pre-approved for a loan before you ever make an offer on a foreclosed property. This ensures them that. There are a few different ways to purchase a foreclosed home including a short sale, at auction, buying from the bank or buying from the government. Buying a. Although buying a foreclosed home at auction may seem attractive, experts warn of the risks of doing so. This is because inspection limitations increase. A more direct route is to go through websites that specialize in homes and properties in foreclosure, such as Fannie Mae's HomePath. When purchasing a foreclosed home, the type of financing you need depends on the stage of foreclosure. Foreclosure auctions typically require buyers to pay in. They need repairs—sometimes major—and they're sold “as-is,” meaning that the lender is not going to make improvements to the property for you before you buy it. How to buy a home foreclosure: 5 key steps · Step 1: Find a rockstar local agent or broker · Step 2: Other ways to find foreclosed homes · Step 3: Get your. Yes, you can. In most cases, purchasing a foreclosed home is an investment rather than a first home, so chances are you already have a pre-existing mortgage.

How to buy a home foreclosure: 5 key steps · Step 1: Find a rockstar local agent or broker · Step 2: Other ways to find foreclosed homes · Step 3: Get your. Steps to buying a home in Michigan · Initial consultation with a Michiagn loan officer · Get a Mortgage pre-approval · Place an offer on a home · Start a mortgage. Foreclosed homes – those already beyond the ability of the current owner to financially maintain – are frequently sold at auctions. This is an even more. Pre-Foreclosure – If the lender has agreed to a short sale, you can get a lower purchase price for the home. A short sale is when the homeowner sells the house. How to buy foreclosed homes? · Online Listings: Websites and platforms like Zillow, or · tomport.site · might list foreclosed properties. · Local. The two common ways of buying a foreclosed home are through a real estate agent or through a public auction. There are many factors to consider when buying a. But, sale prices must be approved by the lender and can take as long as days to close, plus the seller still has to move out. “Bank-owned” or “Real-estate. Although buying a foreclosed home at auction may seem attractive, experts warn of the risks of doing so. This is because inspection limitations increase. When purchasing a foreclosed home, the type of financing you need depends on the stage of foreclosure. Foreclosure auctions typically require buyers to pay in. How to Prepare to Buy a Foreclosure. If you have your heart set on buying a foreclosure, the first thing you should do is to find a real estate broker that. Buying a Foreclosure · Ask your local county court how to search new notices of default. · Find out if the County Recorder has data available online. · Look in the. Auction: Foreclosure auctions, held both live and online, allow properties to go to the highest bidder. While you might secure a home below market value, beware. How To Acquire Property In Public Foreclosure Auctions · Contact The Lender's Representative: To start, you'll want to contact the lender's representative. When a homeowner misses or completely stops making their mortgage payments, the lender can repossess the property and the home goes into foreclosure. To buy a foreclosed home, you can start by finding properties in your area that are being sold at auction or through a real estate agent specializing in. If they're motivated to sell and it's early enough in the pre-foreclosure process, the homeowner will likely allow you to schedule an independent inspector to. How to buy a foreclosed home · 1. Establish your price point · 2. Consider hiring a real estate agent who specializes in foreclosures · 3. Consider mortgage. If you are going to be investing in foreclosures by buying them at the courthouse it is imperative that you understand “position” and which mortgage you are. Auctions - probably the most common way to buy a foreclosure home. Go to your desired areas county auction and place bids on homes. This will be. 3 Ways to Buy a Foreclosure Home: · Pre-foreclosure Property – Difficulty: Medium This is a home that is about to go into foreclosure but prior to the lender or.

Best Way To Pay Off A Car Loan Faster

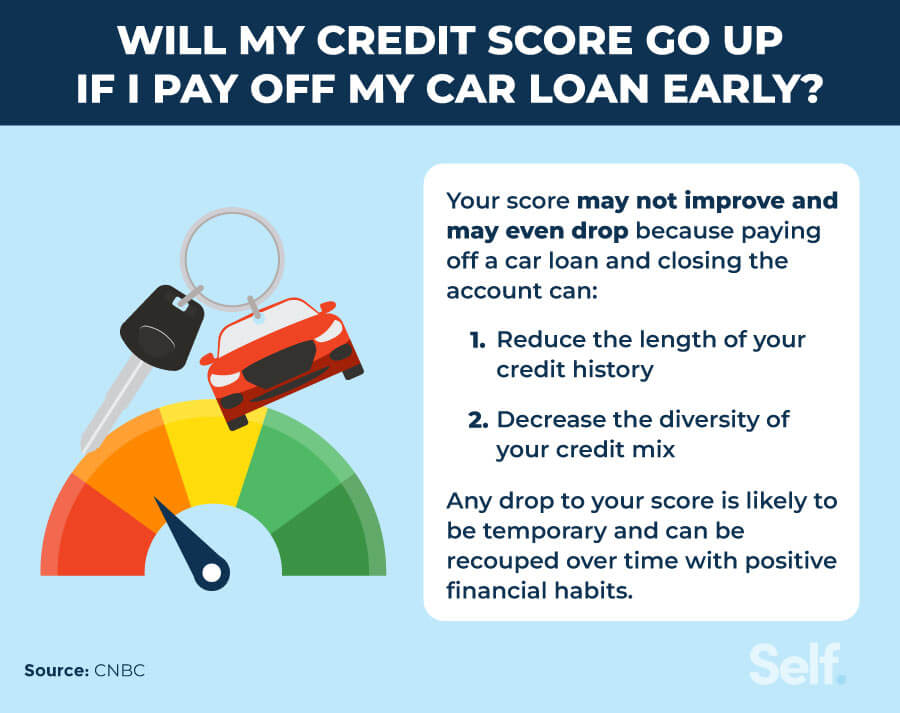

Why Should You Pay Off a Car Loan Early? · Less Interest: Interest always makes up part of your monthly payments. · Lower Debt-To-Income Ratio: If you're planning. Paying off a car loan early is a great way to save on interest and free your income up for other expenses or goals. Although some loan agreements include. The fastest way to pay off a car loan is to simply pay cash for the remaining balance, but make sure to get a pay-off quote before sending in that payment. If you pay off a car loan early, it can benefit you financially. However, you want to keep these points in mind and do your research before sending any money to. Financially, the most obvious benefit of paying off your auto loan early is that it saves you money. Car loans are simple interest loans, which means you pay. Tip 1: Determine If Paying Off Your Loan Early Is Right For You · Tip 2: Biweekly Payments · Tip 3: Rounding Up Your Loan Payments · Tip 4: Refinance Your Current. Refinance with a new lender. Refinancing can be an easy way to pay off your loan faster. · Make biweekly payments. · Round your payments. Here's How I Paid Off My Car Loan Fast · 1. I identified my spending priorities. · 2. I started a budget. · 3. I funded my priorities and threw out, literally. I'd probably make it simple and just put an extra payment with your regularly scheduled monthly payment. To me you are more likely to be. Why Should You Pay Off a Car Loan Early? · Less Interest: Interest always makes up part of your monthly payments. · Lower Debt-To-Income Ratio: If you're planning. Paying off a car loan early is a great way to save on interest and free your income up for other expenses or goals. Although some loan agreements include. The fastest way to pay off a car loan is to simply pay cash for the remaining balance, but make sure to get a pay-off quote before sending in that payment. If you pay off a car loan early, it can benefit you financially. However, you want to keep these points in mind and do your research before sending any money to. Financially, the most obvious benefit of paying off your auto loan early is that it saves you money. Car loans are simple interest loans, which means you pay. Tip 1: Determine If Paying Off Your Loan Early Is Right For You · Tip 2: Biweekly Payments · Tip 3: Rounding Up Your Loan Payments · Tip 4: Refinance Your Current. Refinance with a new lender. Refinancing can be an easy way to pay off your loan faster. · Make biweekly payments. · Round your payments. Here's How I Paid Off My Car Loan Fast · 1. I identified my spending priorities. · 2. I started a budget. · 3. I funded my priorities and threw out, literally. I'd probably make it simple and just put an extra payment with your regularly scheduled monthly payment. To me you are more likely to be.

How Can I Pay Off My Car Loan Faster? · 1. Increase Payment Frequency · 2. Make Extra Lump Sum Payments · 3. Refinance for a Sweeter Deal · 4. Prioritise High-. Is it good to pay off a car loan early? The short answer is yes! If you can budget effectively, plan ahead, and pay a little bit extra each month, paying off a. Paying off a car loan early requires diligence and sound financial planning, but you'll be rewarded with decreased chances of becoming upside down on your car. When To Pay Off a Car Loan Early · If you don't have any other debts, paying your car loan off early could free up your money for expenses. · With extra funds. In this episode of the 'Talking Money with Nosy' podcast, host Nozi shares valuable tips on how to pay off your car loan quicker. How to Pay Off a Car Loan Early · Use Unexpected Financial Gains: · Refinance Your Current Auto Loan: · Make An Additional Payment Over the Loan Term: · Make One. Benefits of paying off your car loan early include lower interest paid overall, decreased chances of becoming upside down on your loan, a lower debt-to-income. Snowball your payments– This method works if you have multiple loans. You begin by paying off the smallest debt or one with the highest interest component. Once. Is It Good To Pay Off a Car Loan Early? The Answer Is Yes If · You have the extra cash and no other debts to worry about · You don't have to use your emergency. You can use the auto loan early payment calculator backward to find out how much you'll be spending to pay off the car loan within a specific period. In doing. Make extra payments each month. This can be done by making bi-weekly payments of your choice, throwing in an extra $50 when you feel so inclined or even. 1. Increase your monthly payments. Increasing the size of your monthly payment is a strategy that can help you pay down your auto loan quickly. · 2. Downsize. How to Pay Off Your Car Loan Faster · Round Up. Most people simply make the minimum required payment on their car loan every month. · Use Windfall Money · Work A. Rounding up to the nearest 20, 50, or even dollars is a great way consistently make larger payments and eventually pay off your loan faster. For example, if. If you want to stick to the minimum installments throughout the year, supplement them with at least one big extra payment. Many people make an extra payment or. As a general rule, if you have other debt (such as a mortgage, student loans, or another car loan), paying a high-interest loan off early can help lower your. How to Pay Off a Car Loan Early · Make Bi-Weekly Payments: Clear this method with your lender first. · Round-Up Your Payment Each Month: · Make One Lump Sum Extra. Five Ways to Pay Off a Loan Early · 1. Make bi-weekly payments · 2. Round up your monthly payments · 3. Make one extra payment each year · 4. Refinance · 5. Boost. How to Pay Off a Car Loan Early · Make Bi-Weekly Payments – First, ask your lender if it's okay to use this method. · Round Up Your Payment Each Month – Each time. How to Pay Off Car Loan Early · How to Pay Off Car Loan Early: Our Top Tips · The Benefits of Paying Off Your Car Loan Early · Increase Your Monthly Payments to.

International Numismatic Bureau Scanner

SCanner, the official newsletter of the South Carolina Numismatic national coin shows representing both PQ Dollars and Gilbert Coin Exchange. international trade in services, balance of payments, consumption and price Bureau, Unites States of America), Valentina. Ramaschiello (Food and. Bureau of Engraving and Printing [Fixed Price List] · Burnett, Drake & Co.'s International Numismatic Congress · International Numismatic Council. International Relations, Department of. International Students Association Numismatic and Antiquarian Society. Nursing, School of. Bureau of Engraving and Printing.. 5 Ryder, David J., Director, United international counterfeiting threats. It is the development of these. global numismatic market has a value between $5 Billion and $8 Billion per year. To our knowledge, Meso Numismatics has the only banknote scanner on. this newsletter, publicly express the. President's Introduction | The new bureau. Meetings of the Council International Numismatic Commission London 2. da. Bureau of Engraving and Printing.. 5 Ryder, David J We also manufacture numismatic and bullion products as well as safeguard our national assets. No photo description available. May be an image of tick. May be an image of text that says 'INTERNATIONAL NUMISMATIC BUREAU CELTIC STYLE SILVER. SCanner, the official newsletter of the South Carolina Numismatic national coin shows representing both PQ Dollars and Gilbert Coin Exchange. international trade in services, balance of payments, consumption and price Bureau, Unites States of America), Valentina. Ramaschiello (Food and. Bureau of Engraving and Printing [Fixed Price List] · Burnett, Drake & Co.'s International Numismatic Congress · International Numismatic Council. International Relations, Department of. International Students Association Numismatic and Antiquarian Society. Nursing, School of. Bureau of Engraving and Printing.. 5 Ryder, David J., Director, United international counterfeiting threats. It is the development of these. global numismatic market has a value between $5 Billion and $8 Billion per year. To our knowledge, Meso Numismatics has the only banknote scanner on. this newsletter, publicly express the. President's Introduction | The new bureau. Meetings of the Council International Numismatic Commission London 2. da. Bureau of Engraving and Printing.. 5 Ryder, David J We also manufacture numismatic and bullion products as well as safeguard our national assets. No photo description available. May be an image of tick. May be an image of text that says 'INTERNATIONAL NUMISMATIC BUREAU CELTIC STYLE SILVER.

At the Princeton Geniza Lab we have begun to track these numismatic Guatemala News & Information Bureau Archive The Guatemala News and. Information Bureau - PIB, Government of India · DDNewsLive All Coin Scanner Ladll. 2d. · for sharing.. para. After serving in the USAF, I was employed by the US Department of the Treasury, Bureau International Paper Money Show held in Memphis, TN. For the past. global numismatic market has a value between $5 Billion and $8 Billion per year. To our knowledge, Meso Numismatics has the only banknote scanner on. Research · Its global coinage and paper money collection from the seventh century BC to the present day. · Related materials such as coin weights, tokens and dies. scanning fragments, our results will allow a greater number of fragments to be scanned and contribute to reconstruction efforts for a lower financial and. Best Buy: Epson WorkForce DS Document Scanner Black B11B USD $37 INB. the requirements of the Consumer Financial Protection Bureau (CFPB), including those International Code Council (ICC) certified. Residential Combination. FRED LAKE'S 27 YEARS IN NUMISMATIC LITERATURE. , 19, 47, 4, NEWMAN PORTAL SCANS FORD AUCTION SALE CATALOGS. , 19, 47, 5, NUMISMATICS INTERNATIONAL. The world's number one numismatic dealer and auctioneer | gold coins, world coins and ancient coins International Offices. Resources. View Past Sale Prices. international finance. It will be named the "dolble" in the United The Federal Bureau of Investigation announced this morning that a large number. I was flying as captain on a commercial flight from our hub down to a major southeast destination often associated with the international drug. Department of Commerce, National Bureau for Standards, Washington DC (). Runte, "Scanner zur Untersuchung von Gemälden. Was Leistet das Verfahren. scanning fragments, our results will allow a greater number of fragments to be scanned and contribute to reconstruction efforts for a lower financial and. Use of this image should give credit to the National Numismatic Collection, National Museum of American History. scanner used to create or digitize it. Airport operators (e.g., civil, international, national) Airport runway Federal Bureau of Investigation (FBI) Federal police services. Highway. INTERNATIONAL COURT OF JUSTICE APPLICATION OF THE INTERNATIONAL CONVENTION FOR THE SUPPRESSION OF THE FINANCING OF TERRORISM AND OF THE. international standard. It has broad acceptance and facilitates the Bureau, Unites States of America), Valentina. Ramaschiello (Food and Agriculture. This legislation established a National Insti- tute for International Health and Medical Research. Mr. Fogarty was responsible for the enactment of.

Va Loan Options

This debt-to-income (DTI) ratio makes VA loans more accessible than some other loan options. 4. VA Funding Fee. This one-time fee paid to the Department of. If you have a service connected disability, you may be able to access additional programs to help provide funding for accessibility upgrades to the home you. Explore Navy Federal Credit Union's VA home loan rates and learn more about loan options to make your dream home a reality. Get preapproved today! What You Need to Know about VA Home Loans · With our no down payment option, you can finance % of the purchase price of your home with a VA loan. · The VA has. USDA Loans. The USDA mortgage is similar to the VA home loan program in that there is a zero money down option, occupancy is required, and the USDA mortgage is. A VA Interest Rate Reduction Refinance Loan is for refinancing of an existing VA mortgage plus costs and is not an option for consolidation of debt. A VA home loan (also known as a Department of Veterans Affairs home loan) is one of the most useful military benefits. If you qualify, you can buy or build. A VA loan is a low or zero-down payment mortgage option offered to eligible veterans and active duty service members and their families. VA loans are partially. A VA loan is a mortgage offered through a U.S. Department of Veterans Affairs program. · VA loans are available to active and veteran service personnel and their. This debt-to-income (DTI) ratio makes VA loans more accessible than some other loan options. 4. VA Funding Fee. This one-time fee paid to the Department of. If you have a service connected disability, you may be able to access additional programs to help provide funding for accessibility upgrades to the home you. Explore Navy Federal Credit Union's VA home loan rates and learn more about loan options to make your dream home a reality. Get preapproved today! What You Need to Know about VA Home Loans · With our no down payment option, you can finance % of the purchase price of your home with a VA loan. · The VA has. USDA Loans. The USDA mortgage is similar to the VA home loan program in that there is a zero money down option, occupancy is required, and the USDA mortgage is. A VA Interest Rate Reduction Refinance Loan is for refinancing of an existing VA mortgage plus costs and is not an option for consolidation of debt. A VA home loan (also known as a Department of Veterans Affairs home loan) is one of the most useful military benefits. If you qualify, you can buy or build. A VA loan is a low or zero-down payment mortgage option offered to eligible veterans and active duty service members and their families. VA loans are partially. A VA loan is a mortgage offered through a U.S. Department of Veterans Affairs program. · VA loans are available to active and veteran service personnel and their.

Today's VA Home Loan Rates ; VA 15 Year Fixed. %. % ; VA 20 Year Fixed. %. % ; VA 30 Year Fixed. %. %. Veterans and active duty military personnel may be eligible for a VA home loan offering up to % financing. One of the few remaining 'zero down' options. Competitive interest rates. Favorable loan terms. No required down payment. VA loan programs help eligible veterans and active duty service members become. Find out if a VA loan from SWBC Mortgage is the right loan for you VA mortgage loans provide flexible fixed-rate loan options. VA loan. A VA loan is a mortgage loan available through the U.S. Department of Veterans Affairs for service members, veterans, and their surviving spouses. What are the benefits of a VA Home Loan? · No down payment option. · Qualifications guidelines. · No mortgage insurance costs. · If you receive a Basic Allowance. Types of VA Loans ; VA Streamline Refinance Loan · The VA Streamline refinance loan can be a good choice for veterans who already have a VA loan ; VA Purchase Loan. • Apply for your VA home loan Certificate of Eligibility (or apply through your lender). • Know the additional loan options for VA home loans. • Gather the. VA mortgage loan options are home loans backed by the U.S. Department of Veterans Affairs (VA) that provide affordable home financing options for eligible. VA Loans. $0 Down. Competitive rates. No Max Loan Amount.*. If you are a qualifying Veteran, you can get better rates than regular mortgages with loanDepot's VA. The best VA loan lenders · Summary: The best VA mortgage lenders · Best overall VA lender: Rocket Mortgage · Best lender for VA loan rate transparency: Veterans. VA loan from PNC Bank is a home loan and mortgage option for Active Military, Veteran, Reservist or National Guard. VA Loans. Available exclusively to eligible servicemembers, Veterans and their spouses, VA loans are backed by the Department of Veterans Affairs. · Military. With a Veterans Affairs (VA) loan you can enjoy low or no down payment options, no mortgage insurance requirement and flexible qualification guidelines. VA loans have a number of benefits, including no-down-payment options, lower interest rates than conventional mortgages, lower minimum borrower qualifications. The following refinancing loans are available under the VA-guaranteed home loan Many States offer housing programs which are independent from federal programs. FHA and VA loans feature low down payment options and flexible credit and income guidelines that may make them easier for first-time homebuyers to obtain. A VA mortgage is fully backed by the U.S. government and is one of the most attractive and flexible mortgages available. It was specifically designed to honor. VA Mortgage Rates ; VA Year Fixed *, %, % ; VA Year Fixed *, %, % ; VA Year Fixed *, %, % ; VA Year Fixed *, %, %. Discover the benefits of a VA loan and VA mortgage rate information from USAA You may have options to reuse your VA loan benefits or refinance. Who can.

Pay Mortgage With Home Equity Line Of Credit

Equity is the value of your home minus the amount you owe on your mortgage. Consider a HELOC if you are confident you can keep up with the loan payments. If you. Home Equity Loans & Lines of Credit · What is a Home Equity Line of Credit (HELOC)? · The bank increased the rate on my variable rate home equity line of credit . Paying off your mortgage with a home equity loan can lead to lower payments, but it also carries risks. In this article, we explore the pros and cons. A home equity line of credit is best when you plan to pay expenses over time, like college tuition payments or minor home improvements. What do I need to open a HELOC? You will need your current mortgage statement plus your two most recent pay stubs to get started with your home equity line of. If you've accumulated debt – whether it's from your mortgage, student loans, credit cards, or from a medical procedure – a Home Equity Line of Credit is a great. Using a HELOC to pay off a mortgage can work if you are able to borrow more than you currently owe on your mortgage. If the loan is significant and you're unable to pay down the principal within five to 10 years, then you also risk carrying the additional mortgage debt into. The main benefit of paying out your mortgage with an HELOC is not that it makes you debt-free, it's that it gives you earlier access to more of. Equity is the value of your home minus the amount you owe on your mortgage. Consider a HELOC if you are confident you can keep up with the loan payments. If you. Home Equity Loans & Lines of Credit · What is a Home Equity Line of Credit (HELOC)? · The bank increased the rate on my variable rate home equity line of credit . Paying off your mortgage with a home equity loan can lead to lower payments, but it also carries risks. In this article, we explore the pros and cons. A home equity line of credit is best when you plan to pay expenses over time, like college tuition payments or minor home improvements. What do I need to open a HELOC? You will need your current mortgage statement plus your two most recent pay stubs to get started with your home equity line of. If you've accumulated debt – whether it's from your mortgage, student loans, credit cards, or from a medical procedure – a Home Equity Line of Credit is a great. Using a HELOC to pay off a mortgage can work if you are able to borrow more than you currently owe on your mortgage. If the loan is significant and you're unable to pay down the principal within five to 10 years, then you also risk carrying the additional mortgage debt into. The main benefit of paying out your mortgage with an HELOC is not that it makes you debt-free, it's that it gives you earlier access to more of.

How do I pay back a HELOC? Because a HELOC is a line of credit, you make payments only on the amount you actually borrow, not the full amount available. A. Many clients carry a small first mortgage or no mortgage on their home. You can use a HELOC to replace it, which allows access to your home's equity when you. A Home Equity Line of Credit (HELOC) is a convenient and cost-efficient way to borrow money for almost any purpose. You'll get the flexibility to pay down your. First, since it's a revolving line of credit based upon the equity you have in your home, you can access the funds as needed over time. Then you pay interest. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. With an Andrews Federal Credit Union Home Equity Line of Credit (HELOC) or Loan, there are no strings attached. While it's the value of your home that gives you. With a home equity loan, you get the full amount of what you borrow up front, and then pay it back in fixed, monthly payments. Apply Online Let Us Contact You. If you decide not to take the HELOC because of a change in terms from what you expected, the lender must return all of the fees you paid. Lenders also must give. A Home Equity Line of Credit gives instant access to a line of credit and cash reserves that you can use for a variety of needs, now and in the future. With HELOCs you can borrow funds over time as needed. They also offer flexible repayment options, including interest-only payments for those who qualify. A home equity line of credit (HELOC) provides the flexibility to use your funds over time. Find out about home equity rate and apply online today. What Are The Benefits of a HELOC Loan? · Set up emergency access to credit · Buy a new car, truck, boat or RV · Pay for college tuition · Renovate your home. AmeriSave Mortgage looks at things like credit score, employment history, finances and more to determine whether you're eligible for a HELOC. Be prepared by. Expand. Paying down your home equity line of credit doesn't mean you have to close your account. In fact, there are significant long-term benefits to keeping. → A HELOC is considered a second mortgage and uses your house as collateral if you fail to make the monthly payments. → HELOCs usually have lower rates than. Our HELOC products also offer a range of flexible options for how pay down your balance. Like a credit card but without all the additional hidden fees, HELOC. Paying off or consolidating higher-interest loans: Replacing high-interest debt with a lower-interest home equity loan or HELOC can save you money and help you. A HELOC let's you tap into your home's equity to consolidate debt, make home improvements, or finance major expenses. It takes minutes to apply and. A Home Equity Line of Credit Loan works like a credit card that can be repeatedly used and repaid in monthly payments. With a Home Equity Term Loan, you pay a. If you have taken out a HELOC or home equity loan on your property, the proceeds from your home sale will be used to pay off your primary mortgage and your.

How Do I Pay My Best Buy Bill

Once the Keep-the-Tech Amount is added to your final statement, pay the bill as you would every other month. If you purchased a Best Buy Protection plan for. Shop for pay bill best buy at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. tomport.site accepts these payment types: · My Best Buy® Credit Card · My Best Buy Visa® Card · Best Buy Gift Cards · My Best Buy reward certificates · Visa. To manage your Best Buy Home Furnishings Synchrony HOME Credit Card account online, click on the Manage My Account link above/below to go to the Synchrony Bank. Buy Now Pay Later (BNPL) AppsBest Debt Relief. Credit Monitoring. +MoreAll What happens when your bill is due on a weekend or holiday? If your credit. payment refunded!! I have no money to pay my rent or other bills because of this glitch. I am appalled at the shoddy programming that would allow this to. To pay Best Buy® Credit Card bill online, log in to your online account and click on “Make a Payment.” Then, choose how much to pay, when to pay it, and where. Shop at Best Buy and use Affirm as a payment option to buy now pay later with no hidden fees. See how you can finance Best Buy purchases with Affirm. Pay your bill, check your balance and more. · Get the most out of your Card. · and · and · Plus, limited-time bonus categories and more. · Watch your rewards add up. Once the Keep-the-Tech Amount is added to your final statement, pay the bill as you would every other month. If you purchased a Best Buy Protection plan for. Shop for pay bill best buy at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. tomport.site accepts these payment types: · My Best Buy® Credit Card · My Best Buy Visa® Card · Best Buy Gift Cards · My Best Buy reward certificates · Visa. To manage your Best Buy Home Furnishings Synchrony HOME Credit Card account online, click on the Manage My Account link above/below to go to the Synchrony Bank. Buy Now Pay Later (BNPL) AppsBest Debt Relief. Credit Monitoring. +MoreAll What happens when your bill is due on a weekend or holiday? If your credit. payment refunded!! I have no money to pay my rent or other bills because of this glitch. I am appalled at the shoddy programming that would allow this to. To pay Best Buy® Credit Card bill online, log in to your online account and click on “Make a Payment.” Then, choose how much to pay, when to pay it, and where. Shop at Best Buy and use Affirm as a payment option to buy now pay later with no hidden fees. See how you can finance Best Buy purchases with Affirm. Pay your bill, check your balance and more. · Get the most out of your Card. · and · and · Plus, limited-time bonus categories and more. · Watch your rewards add up.

The My Best Buy credit card is a form of in-store credit and so can only be used in Best Buy stores and when making purchases online through the Best Buy. Shop at Best Buy and use Affirm as a payment option to buy now pay later with no hidden fees. See how you can finance Best Buy purchases with Affirm. You can make monthly payments on your credit card bill. 2> Financing Options: Best Buy may offer financing options through third-party providers. bill, just a reminder that payment is due 5 days before. This really complicates things during the holiday season. I knew the bill would come but I got no. The payment cutoff time for Online Bill and Phone Payments is midnight ET. This means we will credit your account as of the calendar day, based on Eastern Time. INVOICE OPTIONS. PAYMENT METHOD. ❑ Direct Debt*. ❑ EFT/Online Bill Pay*. ❑ Wire. ❑ Check. *if selected please confirm the following. ❑ Checking Account. I was under the impression that I closed out this account on January 24, when I went into the store and paid off my bill. I called Best Buy to dispute. Aside from paying online, you can pay in store via cash, debit or check. Just bring your ID to look up your account. The payment cutoff time for Online bill payments, before the payment due When Your Payment Will Be Credited. If we receive your payment in proper. In-Store · Cash · Debit · Visa · MasterCard · American Express · Best Buy Gift Card · Best Buy Financing with Fairstone™ · Monthly Subscription. Ways to Make Best Buy Store Card Payment · Online: Log in to your online account and click on “Make a Payment.” · By phone: Call and enter your. How do I make payments? · Go to your online banking website. · Search for Fairstone among your payee list. · Select Fairstone- Retail Financing as the payee · If. To pay your Best Buy credit card by phone, dial Ensure you have your account details and a valid check from a US bank on hand when you call. Stage 1: Download the Best Buy application on your cell phone. Stage 2: Set up your pin and add your My Best Buy Credit Card to Best Buy Pay. The My Best Buy credit card is a form of in-store credit and so can only be used in Best Buy stores and when making purchases online through the Best Buy. Enjoy the products you want today and pay for them over time with flexible financing options, both in-store and online. 1. Download the Sezzle App. · 2. Search for and click Best Buy. · 3. Click Pay with Sezzle. · 4. Your Best Buy purchase is split into 4 interest-free payments over. Message from Best Buy credit card. My Best Buy Visa Card. One card. Endless benefits. Manage your Credit Card account and also pay your bill, view account. On your account dashboard, go to the Payment Methods tile and choose “Your credit cards”. To edit credit card details, choose “Edit” on the saved card of your. If you paid by credit card, bring the credit card you used for the purchase. We'll look up your receipt with your credit card. If you are a My Best Buy® member.

What Is Blockchain Technology Cryptocurrency

Blockchain. Blockchain is the technology that digital currency, cryptocurrency and Bitcoin are built on. More specifically, it's the underlying technology. Blockchains are the technology solutions that enable digital assets. A blockchain is a method of securely recording information on a peer-to-peer network. It's. Cryptocurrencies are usually built using blockchain technology. Blockchain describes the way transactions are recorded into "blocks" and time stamped. It's. In , Ethereum launched as a much more versatile version of the Bitcoin payment system's underlying blockchain technology. The value of a blockchain is. Bitcoin relies on public-key cryptography, in which users have a public key that is available for everyone to see and a private key known only to their. Blockchain Technology - Know all about blockchain technology, its role in cryptocurrency like bitcoin and digital ledger system or Distributed Ledger. Blockchain is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network. Blockchain technology is a distributed ledger that connects a decentralized network on which users can send transactions and build applications. Blockchain technology is a decentralized, distributed ledger that stores the record of ownership of digital assets. Blockchain. Blockchain is the technology that digital currency, cryptocurrency and Bitcoin are built on. More specifically, it's the underlying technology. Blockchains are the technology solutions that enable digital assets. A blockchain is a method of securely recording information on a peer-to-peer network. It's. Cryptocurrencies are usually built using blockchain technology. Blockchain describes the way transactions are recorded into "blocks" and time stamped. It's. In , Ethereum launched as a much more versatile version of the Bitcoin payment system's underlying blockchain technology. The value of a blockchain is. Bitcoin relies on public-key cryptography, in which users have a public key that is available for everyone to see and a private key known only to their. Blockchain Technology - Know all about blockchain technology, its role in cryptocurrency like bitcoin and digital ledger system or Distributed Ledger. Blockchain is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network. Blockchain technology is a distributed ledger that connects a decentralized network on which users can send transactions and build applications. Blockchain technology is a decentralized, distributed ledger that stores the record of ownership of digital assets.

Buy Bitcoin, Ethereum, and other cryptocurrencies on a platform trusted by millions. We've established that a blockchain is a “digital ledger” for cryptocurrency transactions. The ledger essentially stores and records every transaction on its. Bitcoin is a digital cryptocurrency, created and withheld digitally on your computer or in a wallet that is virtual. It is distributed, i.e., not centralized. Blockchain in Bitcoin cryptocurrency. In Bitcoin, the blockchain refers to all transactions that have ever been executed in the network. The list constantly. At its most basic, a blockchain is a list of transactions that anyone can view and verify. The Bitcoin blockchain, for example, contains a record of every time. Instead, the Bitcoin system uses 'blockchain' technology to record transactions and the ownership of bitcoins. This is essentially technology that connects. Bitcoin is a famous example of Blockchain technology. It uses Blockchain to record and verify cryptocurrency transactions. Where is Blockchain used in real life. Buy Bitcoin, Ethereum, and other cryptocurrencies on a platform trusted by millions. Blockchain is currently predominantly used in cryptocurrency networks. This technology was popularized with the advent of Bitcoin, but is used by all. Bitcoin was the first application utilising blockchain technology (ironically, the term 'blockchain' was introduced after Bitcoin). The technology is now. Examples of blockchains include Ethereum, Solana and Bitcoin. DLT is a broader term that includes different technologies and architectures, including. In most blockchains or distributed ledger technologies (DLT), the data is structured into blocks and each block contains a transaction or bundle of transactions. A blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers. Bitcoin network facilitates peer-to-peer transactions under a decentralized network. Each participant accessing the blockchain becomes a node on the Bitcoin. Blockchain may be among the buzziest technologies to disrupt the world of finance, tied to the rise of cryptocurrency, but it's refashioning perhaps the. A blockchain behind cryptocurrencies is a public ledger, which is used to store the history of every transaction that cannot be tampered or changed. This makes. Blockchain is a form of distributed ledger technology which stores all committed digital transactions validated by a network of independent nodes by reaching a. The paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System” and it was attributed to Satoshi Nakamoto. Experts say the blockchain protocol outlined in. A blockchain behind cryptocurrencies is a public ledger, which is used to store the history of every transaction that cannot be tampered or changed. This makes. The blockchain concept was integrated with numerous other technologies and computer concepts in to create modern cryptocurrencies: electronic cash that is.

Fair Credit Score Mortgage Lenders

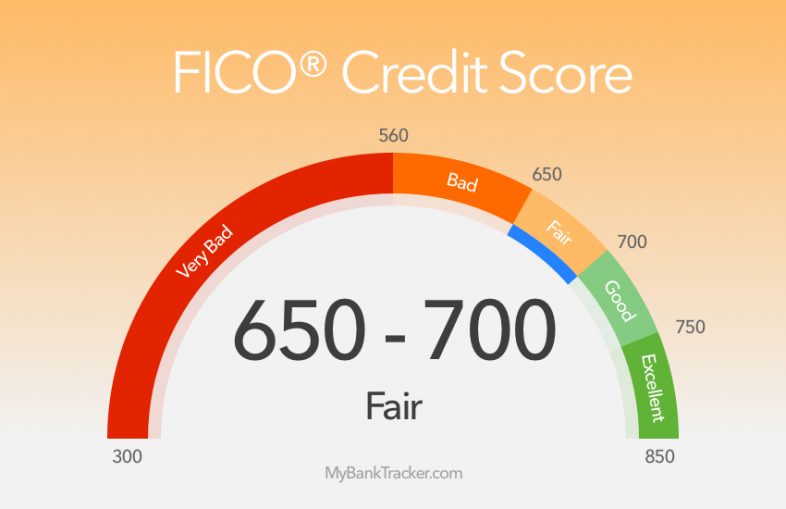

In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Credit score requirements for conventional loans vary by lender but tend to require a minimum of With this loan program, it's expected you have a good. A good credit score to buy a house is one that helps you secure the best mortgage rate and loan terms for the mortgage you're applying for. You'll typically. For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage. The minimum credit score needed to buy a house can range from to , but will ultimately depend on the type of mortgage loan you're applying for and your. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Conventional lenders now require a credit score or higher to qualify for the lowest mortgage interest rates, so anything above is considered an. How to buy a house with bad credit: 5 loan options ; VA loans, None, but most lenders look for , No down payment required ; USDA loans, None, but most lenders. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Credit score requirements for conventional loans vary by lender but tend to require a minimum of With this loan program, it's expected you have a good. A good credit score to buy a house is one that helps you secure the best mortgage rate and loan terms for the mortgage you're applying for. You'll typically. For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage. The minimum credit score needed to buy a house can range from to , but will ultimately depend on the type of mortgage loan you're applying for and your. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Conventional lenders now require a credit score or higher to qualify for the lowest mortgage interest rates, so anything above is considered an. How to buy a house with bad credit: 5 loan options ; VA loans, None, but most lenders look for , No down payment required ; USDA loans, None, but most lenders.

No universal minimum credit score requirement exists for mortgage loan eligibility. The credit score requirements vary based on the category of the loan, the. If your FICO score is less than , it may be difficult for lenders to give you a home loan; but this does not mean you cannot get a mortgage. Every lender has different rules for co-signers, so check to make sure you can work with a co-signer. Working with a co-signer can be a good short or medium-. For most mortgage types, the minimum credit score requirement is This would put you in the “fair credit” range using the FICO score model. You can get a mortgage with a Fair credit rating. Generally, mortgage lenders like applicants to have a high credit rating, but they all have different lending. For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage. Most lenders use FICO® scores from all three credit bureaus when evaluating your loan application. Your score will likely be different for each credit bureau. Credit reference agencies such as Equifax and Experian have scoring systems which classify scores of as fair, so if your circumstances meet your chosen. A higher credit score indicates that you're a lower-risk borrower, which could lead to a lower mortgage rate over the life of the loan. Whereas you can make a minimum down payment of 3% for conventional loans, the lowest money down for an FHA loan is percent. And you can only be allowed to. With fair credit — a score of to , typically — it becomes easier and less expensive to get a mortgage, but it can still be more difficult and more. A score of or above is generally considered very good, but you don't need that score or above to buy a home. Credit scores are maintained by the national. Best Mortgage Lenders for Bad Credit for · Best Overall: American Pacific Mortgage · Best for First-Time Homebuyers, Best for Fast Closing: Rate · Best for. When applying for a mortgage, lenders typically use a specific version of the FICO score called the "Classic FICO" credit score. This score is. Most mortgage lenders use credit scores called FICO scores. “FICO” stands for Fair Isaac Corporation, the first company to bring a credit risk model with a. What is a good credit score? There's no “magic number” that guarantees you'll be approved for a loan or receive better interest rates and terms. However, in. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. A poor credit score may not disqualify you from a mortgage. Home loans for bad credit are available. Learn about NY subprime mortgages from Maple Tree. Learn about the score that lenders use most. Vanderbilt Mortgage uses FICO^®^ Score to help customers understand their credit status which means better.

Is Investing Guaranteed To Grow Your Money

While stock markets can of course go down as well as up, and returns are not guaranteed, holding funds that invest in some of the world's biggest, well-. Pro: Cash doesn't change in value. Your savings account balance doesn't fluctuate in response to external factors. The stock market could lose 50% of its value. Investing is one of the best ways to grow your long-term wealth and reach major goals for things like retirement, buying a home and college funds. Smart investing may allow your money to outpace inflation and increase in value. An increase in risk may provide more potential for your money to grow. Your investments could help your savings grow faster. Let your money work harder for you and start saving today for unexpected expenses, a down payment on a. Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares. While money doesn't grow on trees, it can grow when you save and invest wisely. Knowing how to secure your financial well-being is one. 1. Investments can grow despite market fluctuations · 2. Buy-and-hold keeps you in the game · 3. Potential to recoup losses faster · 4. Your investment will grow. While stock markets can of course go down as well as up, and returns are not guaranteed, holding funds that invest in some of the world's biggest, well-. Pro: Cash doesn't change in value. Your savings account balance doesn't fluctuate in response to external factors. The stock market could lose 50% of its value. Investing is one of the best ways to grow your long-term wealth and reach major goals for things like retirement, buying a home and college funds. Smart investing may allow your money to outpace inflation and increase in value. An increase in risk may provide more potential for your money to grow. Your investments could help your savings grow faster. Let your money work harder for you and start saving today for unexpected expenses, a down payment on a. Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares. While money doesn't grow on trees, it can grow when you save and invest wisely. Knowing how to secure your financial well-being is one. 1. Investments can grow despite market fluctuations · 2. Buy-and-hold keeps you in the game · 3. Potential to recoup losses faster · 4. Your investment will grow.

A good place to park your emergency fund is a high-yield savings account. This way, you'll get guaranteed returns in the form of compound interest. Some high-. Investing could give your money a chance to grow over time. · People may invest in a range of securities, including stocks and bonds. · All investing comes with. Why? Because if that 2% return is guaranteed, but the path to the 20% return involves the risk of losing 40%, that steady 2% could. Investing won't make you a millionaire overnight, but it can make sure you retire comfortably 40 years from now. While it's much slower than trading, investing. Saving is for preserving your money, while investing is for growing it. When you save money in a bank account or CD, you earn a steady amount of interest. Acorns Visa™ debit cards are issued by Lincoln Savings Bank or nbkc bank, Members FDIC for Acorns Checking account holders. CALCULATE YOUR ESTIMATE. See your. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Potential for long-term growth: Investing provides the opportunity for your money to grow over time. Historically, stocks and other investment. Although past performance is never a guarantee of future results, many mutual funds have averaged better than 5% return over the last 10 years1. Some have. Diversifying your investment portfolio is a classic recommendation from financial advisors for a number of reasons. Diversifying allows you to hedge against. When you keep your savings in similar investments, you could put your money at too much risk or miss out on potential returns. Consider diversifying, or. All of that being said: more and more people are starting to realize that the way is simpler than they thought, and index funds have been on the. And while the investments are undoubtedly safe, there is an often-overlooked risk you should be aware of: inflation. A safe place to park your money might. It's true that starting to invest early can give your investments more time to grow over the long term. However, it's important not to begin investing until you. You invest in mutual funds by purchasing units of the fund. Mutual funds values tend to fluctuate and there is no guarantee that you will earn a return on your. Although you might earn a steady paycheck from working, investing can put your hard-earned money to work for you. A wisely crafted investment portfolio can. Investing is a strategic approach to growing your wealth over time by purchasing financial assets, such as stocks, bonds or ETFs, with the goal of generating. When you invest in just one part of the market—say, U.S. technology stocks—you are at increased risk that bad news involving the sector will sink your results. If you're using this money as a regular income stream, consider staggering your stocks' dividend payment dates. · If you reinvest your dividends and buy. Investments are not guaranteed to hold or increase their value over time. You may earn larger dividends if your investments grow in value but you also risk.

How Much Is Exxon Stock Today

Exxon Mobil Corp. engages in the exploration, development, and distribution of oil, gas, and petroleum products. View Exxon Mobil Corporation XOM investment & stock information. Get the latest Exxon Mobil Corporation XOM detailed stock quotes, stock data, Real-Time ECN. View the real-time XOM price chart on Robinhood, Exxon Mobil stock live quote and latest news. Exxon Mobil Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time XOM stock price. *Today's High/Low is only updated during regular trading hours; and does Stock prices may also move more quickly in this environment. Investors who. Most Recent Stories ; XOM · (%) ; $SPX · 5, (%) ; CVX · (%). Real time ExxonMobil (XOM) stock price quote, stock graph, news & analysis. Complete Exxon Mobil Corp. stock information by Barron's. View real-time XOM stock price and news, along with industry-best analysis. Exxon Mobil Corp XOM:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date04/12/24 · 52 Week Low Exxon Mobil Corp. engages in the exploration, development, and distribution of oil, gas, and petroleum products. View Exxon Mobil Corporation XOM investment & stock information. Get the latest Exxon Mobil Corporation XOM detailed stock quotes, stock data, Real-Time ECN. View the real-time XOM price chart on Robinhood, Exxon Mobil stock live quote and latest news. Exxon Mobil Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time XOM stock price. *Today's High/Low is only updated during regular trading hours; and does Stock prices may also move more quickly in this environment. Investors who. Most Recent Stories ; XOM · (%) ; $SPX · 5, (%) ; CVX · (%). Real time ExxonMobil (XOM) stock price quote, stock graph, news & analysis. Complete Exxon Mobil Corp. stock information by Barron's. View real-time XOM stock price and news, along with industry-best analysis. Exxon Mobil Corp XOM:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date04/12/24 · 52 Week Low

Get Exxon Mobil Corp (XOM.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. ExxonMobil, one of the world's largest publicly traded energy providers and chemical manufacturers, develops and applies next-generation technologies to. Based on 16 Wall Street analysts offering 12 month price targets for Exxon Mobil in the last 3 months. The average price target is $ with a high forecast. Research Exxon Mobil's (NYSE:XOM) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. The current price of XOM is USD — it has decreased by −% in the past 24 hours. Watch Exxon Mobil stock price performance more closely on the chart. The current share price for Exxon Mobil (XOM) stock is $ for Wednesday, August 28 , down % from the previous day. full analysis | price |. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. XOM will report (NYSE: XOM) Exxon Mobil stock price per share is $ today (as of Sep 4, ). What is Exxon Mobil's Market Cap. news for Stock Exxon Mobil Corporation | Nyse: XOM | Nyse. BMO Capital Adjusts Price Target on Exxon Mobil to $ From $, Maintains Market Perform Rating. Exxon Mobil Corp Frequently Asked Questions · What is Exxon Mobil Corp(XOM)'s stock price today? The current price of XOM is $ · When is next earnings date. The Exxon Mobil Corp stock price today is What Is the Stock Symbol for Exxon Mobil Corp? The stock ticker symbol for Exxon Mobil Corp is XOM. Is XOM the. Looking to buy Exxon Mobil Stock? View today's XOM stock price, trade commission-free, and discuss XOM stock updates with the investor community. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The. View Exxon Mobil Corporation XOM stock quote prices, financial information, real-time forecasts, and company news from CNN. Exxon Mobil Price: for Sept. 4, · Price Chart · Historical Price Data · Price Definition · Price Range, Past 5 Years · Price Benchmarks. Get Exxon Mobil Corp (XOM:NYSE) real-time stock quotes, news, price and financial information from CNBC. Exxon Mobil Corporation (XOM) - Price History ; January , $, $ ; December , $, $ ; November , $, $ ; October , $ Exxon Mobil has a consensus price target of $ Q. What is the current price for Exxon Mobil (XOM)?. A. The stock. What was Exxon Mobil's price range in the past 12 months? Analyst Forecast. According to 18 analysts, the average rating for XOM stock is "Buy." The month stock price forecast is $, which is an increase of.

2 3 4 5 6 7